Protect Outbound Calls with Financial Services Branded Calling

Voice remains the preferred communication method for 64% of consumers when dealing with financial institutions, but without caller ID, most US adults will not pick up the phone. With 74% of people reporting an increase in robocall scams that spoof legitimate financial companies’ phone numbers, nearly three in four people are refusing to answer unidentifiable calls. Learn more about TNS’ independent research into demand for financial services branded calling.

Branded Calling for Financial Services

The TNS Enterprise Product Suite helps improve and protect financial enterprises’ outbound calling operations by authenticating and branding legitimate calls, while blocking spoof calls. This reassures customers that a call from a bank, financial adviser or mortgage provider is genuine, which helps to restore trust in voice calls and deliver increased answer rates, longer call durations and improved engagement with customers and prospects.

Benefits of TNS Enterprise Product Suite

- Confirms origin of phone calls

- Brands legitimate calls with name and logo

- Blocks calls that do not originate from their identified number

- Reassures customers and prospects that calls are legitimate

- Helps prevent legitimate calls being labeled as spam

- Increases answer rates

- Significantly reduces fraud attempts

- Protects brand reputation

- Reduces exposure to fraud compensation claims

- Available without an app download, on 300m+ Android and iOS devices across the Verizon Wireless, AT&T, T-Mobile and UScellular networks

Increase in customer answer rate for a corporate advisory firm's debt management client using Enterprise Branded Calling.

Financial brands using TNS Enterprise Product Suite.

Spoofed calls blocked for one bank within the first few months of deployment.

Branded calls delivered within the financial industry in 2024.

Customer Interactions Branded Calling Supports

- Discussing policies

- Completing applications

- Confirming details

- Upselling

- Responding to online enquiries

- Case/claim status

Financial Scams Branded Calling Helps Protect Against

- Ghost tax filers

- IRS tax scam calls

- Unpaid toll scams

- Student loan payment scams

- Fund recovery scams

- Financial hardship loan center scams

- Cryptocurrency scams

Smartphones are a Massive Target for Fraudulent Transactions

As mobile phone numbers increasingly serve as the predominant means of identity for billions of individuals globally, financial institutions conduct verification, transactions, and sensitive communications with customers via their smartphones. This presents an opportunity for solution providers like yourself. By augmenting your offerings with authoritative and reliable digital identity data, you stand to attract more financial institutions to opt for your solution over others.

Strengthen Your Fraud Deterrence Solutions

- Differentiate your products and solutions by touting you include the only security constant across the globe—an authoritative phone number database constantly updated for accuracy

- Enhance your clients’ financial performance with solutions that minimize fraud reimbursements and lower operational expenses through effective fraud mitigation measures

- Augment existing processes and systems to mitigate Anti-Money Laundering (AML), account opening fraud, and imposter fraud for your clients

Featured Customers

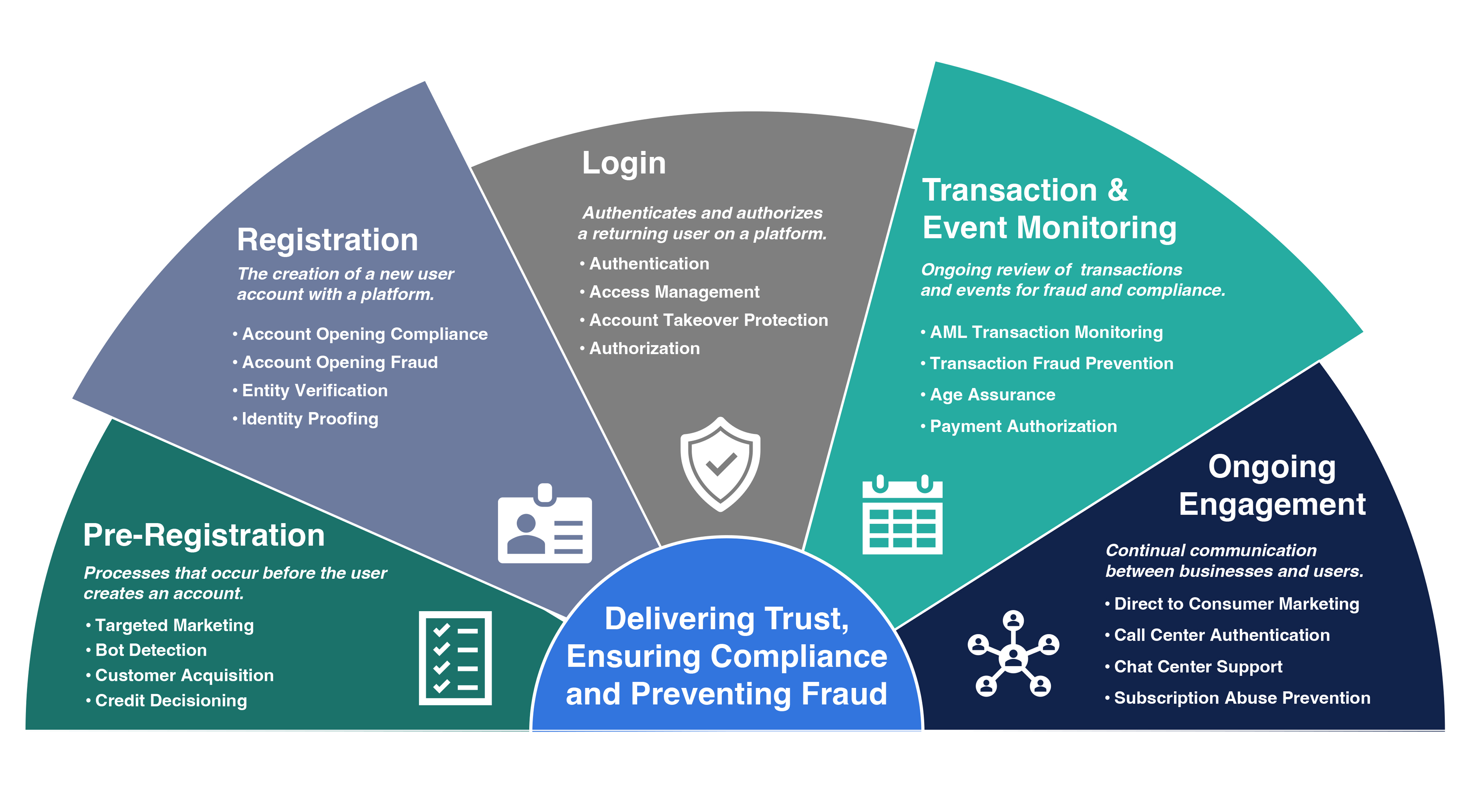

Identity Intelligence Throughout the Customer Lifecycle

The universal role of smartphones in managing personal finances and conducting transactions creates a fertile atmosphere for exploiting vulnerabilities across the customer life cycle. TNS's data and platforms will enhance your solutions every step of the way:

- Customer Journey

- Pre-registration

- Customer Registration

- Customer Login

- Transaction & Event Monitoring

- Ongoing Engagement

Ensure marketing, customer acquisition, and credit activities are verifiable and secure before a user creates an account.

• Targeted Marketing

• Bot Detection

• Customer Acquisition

• Credit Decisioning

Strengthen the registration process by implementing rigorous compliance measures, advanced fraud detection systems, thorough entity verification procedures and comprehensive identity proofing protocols.

• Account Opening Compliance

• Account Opening Fraud

• Entity Verification

• Identity Proofing

Authenticate and authorize returning users for a frictionless experience coupled with account management and takeover protections.

• Authentication

• Access Management

• Account Takeover Protection

• Authorization

• AML Transaction Monitoring

• Transaction Fraud Prevention

• Age Assurance

• Payment Authorizations

• Direct-to-Consumer Marketing

• Call Center Authentication

• Chat Center Support

• Subscription Abuse Prevention

- Customer Journey

- Pre-registration

- Customer Registration

- Customer Login

- Transaction & Event Monitoring

- Ongoing Engagement

Contact Us

Contact us to learn more how TNS Enterprise Product Suite can help your Financial Services business.

Communications Resource Center

TNS' unified call identification platform restores trust to voice and drives the future of next generation communications. TNS analyzes more than one billion calls a day, synthesizing data into widely trusted and utilized robocall protection reports, white papers and other thought leadership. Learn more about TNS' IaaS solutions.